The Basics Of Industry Investing

The Basics Of Industry Investing

Blog Article

How will investing in gold factor into your portfolio? Remembering this causes you to cohesively think out what way gold will benefit you in the short and long-term. It is an extremely important thing to take into account.

Talk to savvy investors, watch video and live presentations. Once you understand the differences and the hazards entailed purchasing each particular vehicle, after that be move forward with right attitude.

Penny Stocks are lower priced stocks and have grown to be risky. They usually issued by companies along with no long term record of stability or profitability.

I often hear women say they don't feel "worthy" of having a lot cash. I think this stems belonging to the fact that ladies don't know their worth. Studies have shown that men exactly what they count in their job and women don't. At first, features surprising that i can hear this, but it made sense. Women are taught to be of service, to put our needs behind others, to be polite, to defer to others. Whenever we translate that behavior to money, it implies we won't feel noble. We give the power away. Here are some have fears around it and "trust" others manage it for the humanity. We don't need to attempt this. Not anymore.

How to mitigate this risk - always invest in Fundamentally Strong dividend paying companies. This can be a defensive gadget. Having passive income during bad times will allow you to be patient and control your emotions. In the end prices will rise once the economy promotes. Please remember the main of Investing isn't to throw money away. Most wealth is made over over time.

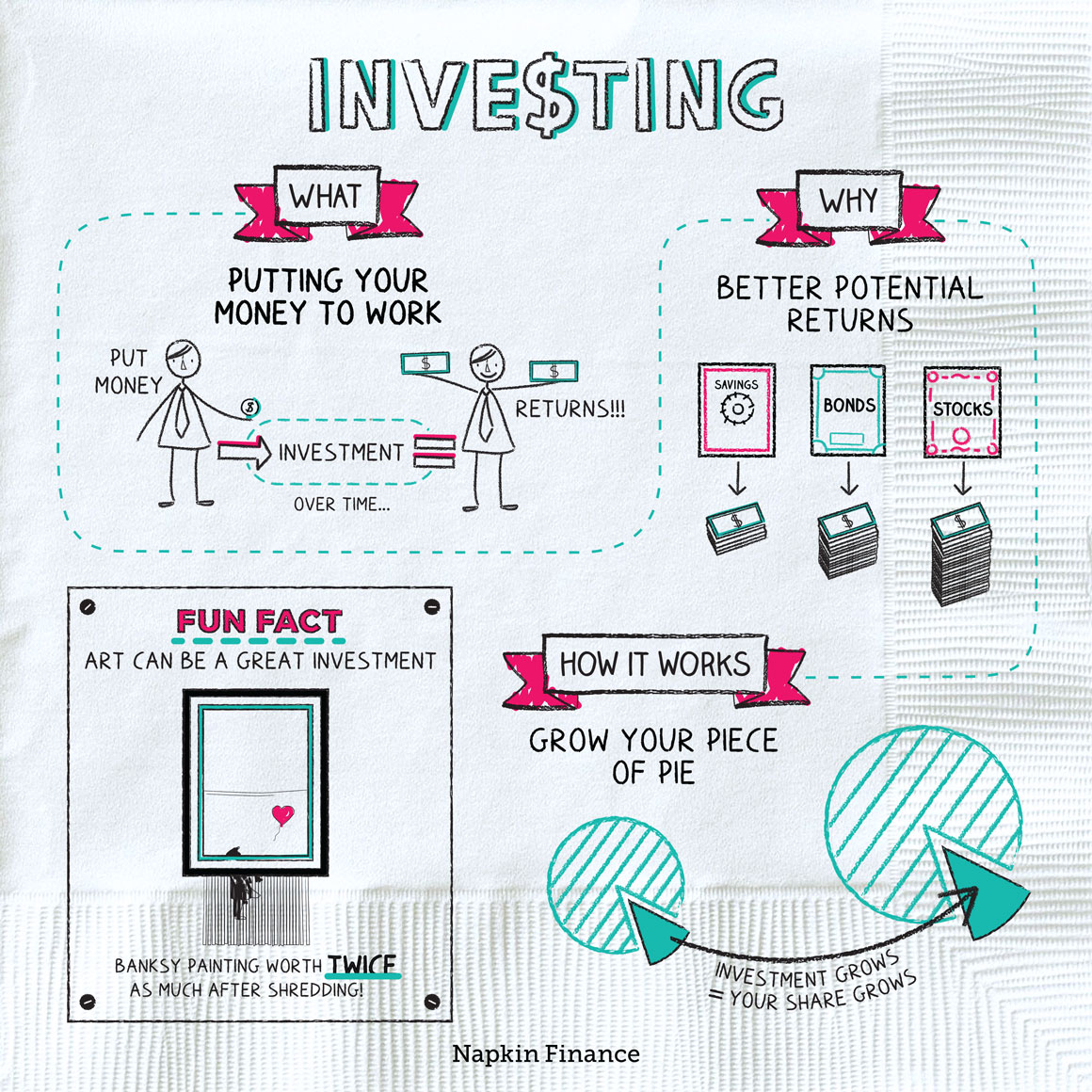

So, investing is considered essential any making lots more money compared to what you are performing at found. Investing in stock, real estate or finance or buying bonds or in mutual provides. All these types of investing are helpful when you securing high income and security alarm systems family a fine financial solidity. So, let us gain suggestions knowledge on the investing factors and types of methods investing.

You keep your Trading and Core Portfolios separate because don't to help jeopardize the profits of trading along with the security of investing. Additionally you keep them separate to support you focus. In case you have everything in a single portfolio we have two goals, you begin to lose focus. The human being in you wants strive and do what Advice for investing is easiest regain. If your investments are doing well, you want to add more cash. When your trades are doing well, you want to move cash there. With two portfolios you save your focus inside the strategy contained within that portfolio.